FHA and you may Virtual assistant funds stay since the exclusive home mortgage apps providing manual underwriting. Gustan Cho Partners specializes in this new guidelines underwriting of FHA and you may Virtual assistant finance. For those navigating the mortgage mortgage procedure in the course of Chapter 13 Case of bankruptcy, manual underwriting is a needed for Va and you may FHA funds. Qualifications to own a keen FHA and Virtual assistant financing are possible pursuing the launch of Section 13 Personal bankruptcy. Submit an application for Va and you will FHA mortgage immediately after chapter 13 personal bankruptcy

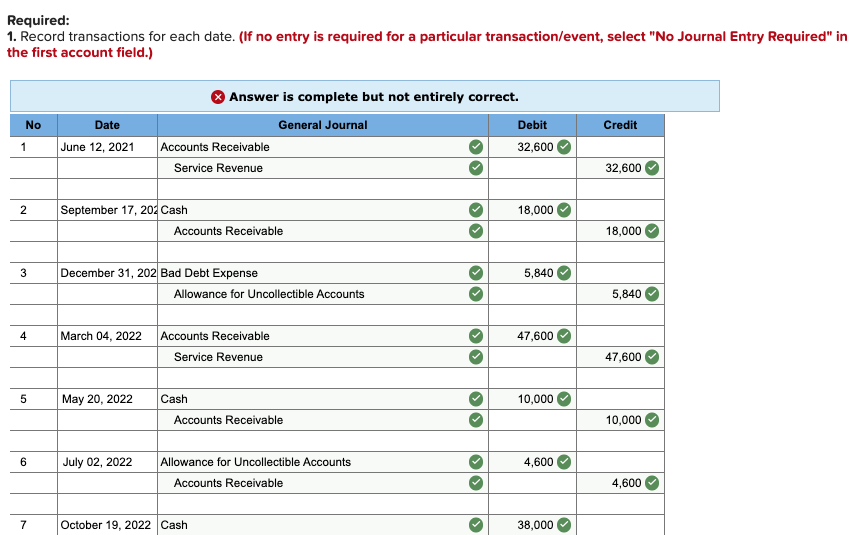

If the release away from Part 13 Case of bankruptcy wasn’t oriented getting no less than a couple of years, the fresh new file must go through manual underwriting. The key difference in guide and you can automatic underwriting program recognition lays about fact that instructions underwriting imposes lower limits on the debt-to-income proportion. A critical ratio of one’s consumers, one or more-3rd, are engaged in an energetic Section thirteen Case of bankruptcy payment bundle otherwise has actually recently complete the fresh Part thirteen Bankruptcy proceeding processes. The following area will outline the mortgage recommendations applicable during Part thirteen Personal bankruptcy fees agreements having FHA and you may Virtual assistant money.

Manual Underwriting Instead of Automated Underwriting Program Recognition

FHA and Va financing is the private mortgage software helping guidelines underwriting to have home mortgages. All FHA and you may Virtual assistant loans inside the Section 13 Bankruptcy fees months proceed through tips guide underwriting. Furthermore, one FHA and you can Virtual assistant money which were discharged but i have maybe not reached a flavoring period of a couple of years try at the mercy of guidelines underwriting. Just like the guide underwriting recommendations to have FHA and you will Va finance is actually nearly the same, its significant one loan providers are more versatile having Va money as compared to FHA finance about manual underwriting process.

Virtual assistant and you can FHA Loans Once Chapter thirteen Case of bankruptcy Qualifications Standards

FHA, Va, and you can Low-QM financing don’t need a standing period following the launch date out of Section thirteen Bankruptcy. Lenders anticipate individuals and then make quick costs on all month-to-month expense post-case of bankruptcy processing. The newest perception recently money after and during Part thirteen Bankruptcy may vary among loan providers. From time to time, a couple later repayments as a consequence of extenuating points will most likely not necessarily obstruct the deal. Still, later repayments post-personal bankruptcy release because of neglecting borrowing will in all probability angle tall obstacles whenever looking to home loan certification and might potentially resulted in termination of one’s bargain.

FHA and you will Virtual assistant DTI Direction While in the Chapter thirteen Personal bankruptcy

Brand new tips guide underwriting guidelines to own FHA and you will Va finance directly reflect one another. So it surrounds brand new tips guide underwriting recommendations into personal debt-to-income proportion into the both FHA and you will Virtual assistant loans. This new confirmation regarding rent, later commission, and you may compensating affairs during Section 13 Bankruptcy having FHA and you will Va finance in addition to display parallels. Any Chapter thirteen Personal bankruptcy one have not been through seasoning for two ages following discharge time demands instructions underwriting. Prequalify getting Virtual assistant and you can FHA financial immediately following chapter thirteen bankruptcy proceeding

DTI Direction to your Guide Underwriting

On this page, we shall delve into the idea of tips guide underwriting. It is important to observe that Va and you will FHA money, especially those acquired when you look at the Section 13 Bankruptcy fee months, want guide underwriting. Tips guide underwriting is special so you’re able to FHA and you will Virtual assistant loans certainly one of certain home loan programs. The latest recommended obligations-to-earnings ratio recommendations both for FHA and Virtual assistant money is once the follows: 31% to the side-prevent and 43% on the right back-avoid without having any compensating situations, 37% into front side-stop and you may 47% to the straight back-avoid which have one to compensating grounds, and 40% on front-avoid and you may fifty% towards right back-stop which have several compensating circumstances.

FHA and you can Va Mortgage Qualification Standards While in Part 13 Bankruptcy proceeding

- Homeowners normally be eligible for good Va and you can FHA financing into the Chapter 13 Bankruptcy proceeding repayment bundle without having the Chapter 13 discharged

Leave a Reply