A job confirmation performs a crucial part on financial acceptance procedure, providing due to the fact a vital checkpoint to own loan providers to assess a beneficial borrower’s power to pay the borrowed funds. This blog post is designed to shed light on this vital aspect of one’s financial techniques, particularly centering on just what lenders come across during the work verification. By the wisdom this step, prospective consumers is also top ready yourself by themselves, improving their odds of protecting a mortgage. Regardless if you are a first-date homebuyer otherwise an experienced possessions buyer, this knowledge will be crucial from inside the navigating the loan land.

A job Records

Might check your work record to check on to possess balances and continuity. A steady jobs records often means a reputable money weight.

Calling Companies

A standard method is privately calling employers. The lending company may label otherwise current email address your employer to confirm their employment status, jobs title, and you may money. This direct get in touch with facilitate loan providers make sure what you’ve given and you will evaluate what you can do to repay the borrowed funds.

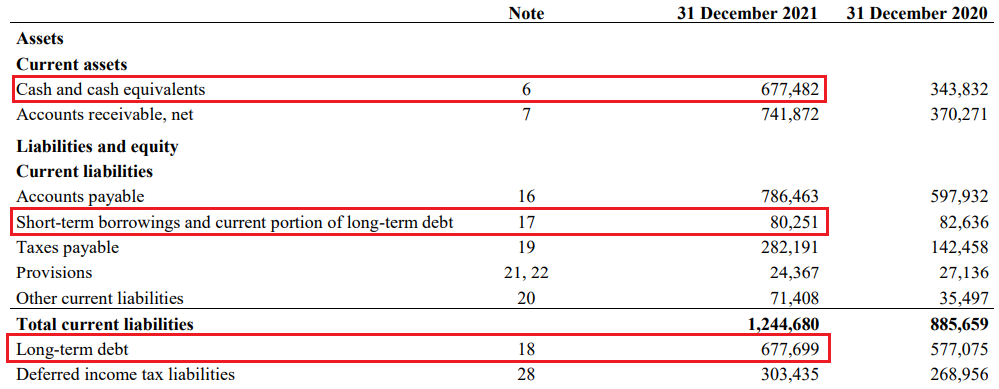

Examining A career Data

Loan providers and feedback a position documents such as for example spend stubs, W-2 versions, otherwise tax returns. These data files just prove your a career and also provide a good detail by detail look at your earnings history. Because of the evaluating these types of data, lenders can make a knowledgeable decision regarding your financial software.

In essence, this type of verification procedures let loan providers minimize chance and ensure he or she is credit to individuals that financially effective at settling the borrowed funds.

Exactly how Care about-Employed Somebody Can also be Be certain that Work

Self-employed people usually deal with unique challenges into the a position verification process. Instead of antique professionals, they don’t have a manager to confirm the money or work condition.

Demands to have Worry about-Employed Individuals

Self-operating anybody ought to provide proof of a reliable income, that is more difficult showing. They may must give even more paperwork such as for example tax statements, business permits, and financial comments in order to verify their earnings and also the life out of its business.

Strategies for Effective Verification

For effective verification, self-working some one should keep direct and up-to-day suggestions of its earnings. Daily updating these details provide an obvious picture of the monetary stability. They should even be ready to render extra documents such contracts or bills to help substantiate the earnings claims.

Just how to Plan Work Confirmation

Best preparing is key to a flaccid mortgage app processes. Check out basic ideas to get ready for employment confirmation:

Continue Work Documents Planned

Getting the a position data eg shell out stubs, tax returns, and you may characters out-of work readily available can expedite brand new confirmation techniques. Remain such Buena Vista loans records organized and easily available.

Be honest Regarding your Work Status

Visibility is crucial. End up being initial regarding the employment updates, also people present change. Loan providers see trustworthiness and it may stop potential situations on the line.

Finding your way through work confirmation renders the mortgage application techniques reduced overwhelming. By keeping their a career documents planned and being sincere regarding the a job status, you could potentially raise your odds of a successful software.

Conclusion

To close out, knowledge exactly what lenders select during the employment confirmation is vital when trying to get a mortgage. This step takes on a life threatening part in deciding the eligibility to own financing. Lenders is attracted to verifying your a career background, income, and you will work updates to assess your capability to repay the loan.

Stable a position is highly respected, and worry about-employed someone could possibly get deal with novel pressures with this process. Although not, which have proper preparing, including staying employment files organized and being honest regarding the a job status, the mortgage application process can be made simpler.

Think of, the goal of employment verification should be to guarantee a successful home loan app. Skills this process increases your odds of mortgage acceptance and make it easier to contain the house you have always wanted.

Leave a Reply